The hotel industry is warning it will default on at least $86 billion in collateralized loans within the next several months and deliver another financial shock to the U.S. economy without more intervention by the federal government, above and beyond the $2 trillion coronavirus bailout package just signed into law by President Donald Trump.

In a March 27 letter addressed to a host of federal regulators, the heads of the American Hotel and Lodging Association and Asian American Hotel Owners Association said the industry's "unprecedented cash flow crisis" brought on by the COVID-19 pandemic requires a separate financial lifeline as well as special protections from the sector's legions of lenders and loan servicers. The letter specifically seeks relief in the so-called non-agency collateralized mortgage-backed securities, or CMBS, market, a stomping ground for Wall Street's biggest lenders and a source for billions of loans to hotel owners throughout the United States.

"Many hotels are unable to pay operating costs and thus debt service," wrote AHLA President Chip Rogers and AAHOA President Cecil Staton in their letter to the U.S. Treasury, Federal Reserve and Securities and Exchange Commission. "This will cause a snowball effect of foreclosures followed by lenders taking ownership of severely distressed assets with no ability to operate them.”

The industry groups seek an unspecified amount of "liquidity" from Treasury and the Fed to enable hotel owners to stay current, and they have asked the SEC to temporarily remove some of the regulatory and credit-ratings requirements that under normal circumstances would force lenders and loan servicers to advance foreclosures due to nonpayment. They estimate seven in 10 hotel rooms now sit empty and that the industry stands to lose $3.5 billion in room revenue each week the crisis persists.

Whereas traditional lenders such as local and regional banks have proven willing to work with hotel owners in navigating the coronavirus crisis, the CMBS market presents a particularly challenging environment for borrowers to navigate, said Randy Meyer, chief financial officer for The Hotel Group in Edmonds, Washington. He said the CMBS market's extensive legal and contract obligations, as well as the hierarchical way in which it is managed, makes it less responsive and far less flexible when dealing with borrowers during a crisis.

The concern, Meyer said, is without federal intervention everyone from hotel owners to real estate investors to the pension funds that own securities in CMBS portfolios will be rocked beyond the losses already tallied since the coronavirus crisis unfolded. Meyer predicted a wave of foreclosures and a fire sale of properties if things continue as is. He said billions in equity, much of it built up by families and property owners over generations, would be wiped out.

"It's a potentially catastrophic scenario," said Meyer, noting that nine of his company's properties have shut down and that similar moves might be in store for its remaining properties if the expanding states of quarantine and social distancing persist or worsen.

Big hotel debts ... and another big bailout?

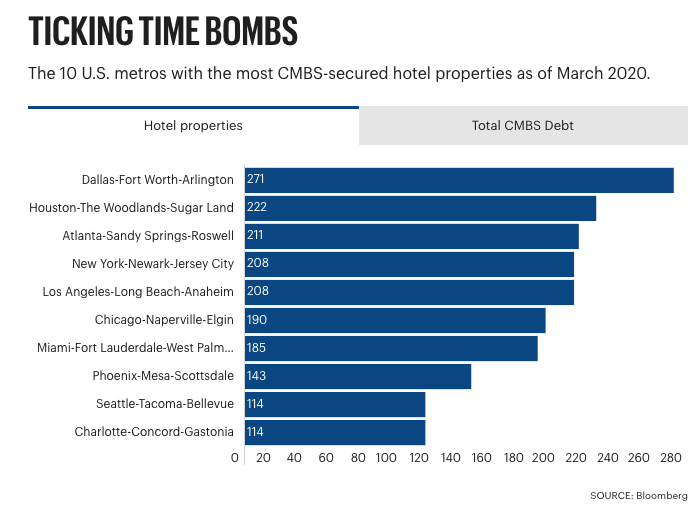

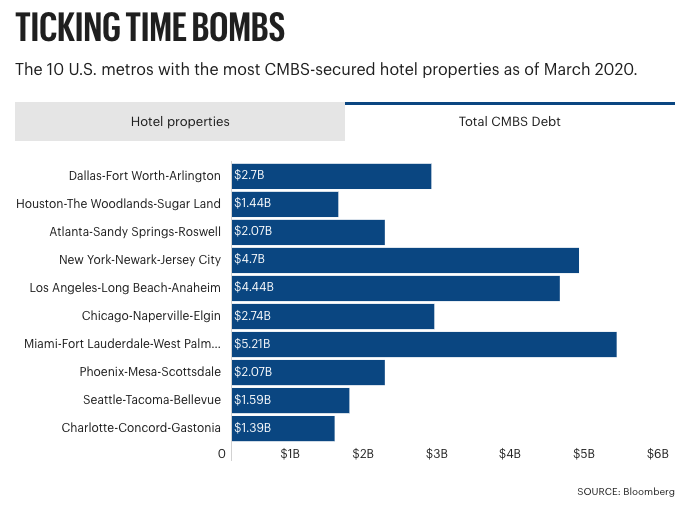

An American City Business Journals analysis identified approximately 8,000 U.S. hotels with $85.6 billion in CMBS loans outstanding as of this month, with an average loan balance of $10.7 million per property. The hotel industry estimates there is another $220 billion in traditional mortgage debt supporting hospitality and lodging properties nationally.

Without federal intervention and relief, industry experts say the carnage will be widespread and result in a state of instability in business and tourism centers for years to come.

The Charlotte-Concord-Gastonia metropolitan statistical area has about $1.39 billion in CMBS loan balance in 114 hotel properties — the 10th highest MSA evaluated by ACBJ, parent company of the Charlotte Business Journal. The average debt per hotel property in the Charlotte MSA is $12.2 million.

Some of that debt is carried in large national portfolios with hundreds of millions in loan balances.

Locally, CMBS hotel properties include a mix of flags and submarkets, including several prominent uptown hotels such as the Marriott Charlotte City Center. A number of hotels near Charlotte Douglas International Airport — DoubleTree by Hilton Hotel Charlotte Airport, Hampton Inn & Suites Charlotte Airport and Hilton Garden Inn Charlotte Airport Hotel, among others — are included.

The 207-room DoubleTree by Hilton Hotel Charlotte-SouthPark Mall, at 6300 Morrison Blvd., has a loan balance of $30 million across multiple CMBS portfolios.

The Marriott Charlotte City Center hotel, which underwent a $40 million renovation in 2016, was acquired by a non-traded REIT of W.P. Carey (NYSE: WPC) in 2017 for $170 million. It has an outstanding balance of $103 million in multiple loans.

And The Ballantyne, one of Charlotte’s most prestigious hotels, has an outstanding loan balance of $55 million. The hotel, acquired in 2017 as part of Northwood Investors’ blockbuster Ballantyne deal, also underwent a multimillion-dollar renovation less than two years ago.

In the Miami-Fort Lauderdale metro, some 185 properties backing $5.2 billion in CMBS debt hangs in the balance. Affected properties include some of Miami Beach's most prominent oceanfront hotels, including The Fontainebleau and Edon Roc, as well as dozens of smaller sites operating under national flags ranging from Holiday Inn to Aloft to Homewood Suites.

With 271 properties securing $2.7 billion in loans, the Dallas-Fort Worth metro has the most CMBS-financed hotel properties. Houston ranks second with 222 properties financed with $1.4 billion in outstanding CMBS debt. Included in those lists of properties are Sheratons, Hiltons, Crowne Plazas and virtually every other major hotel brand in America.

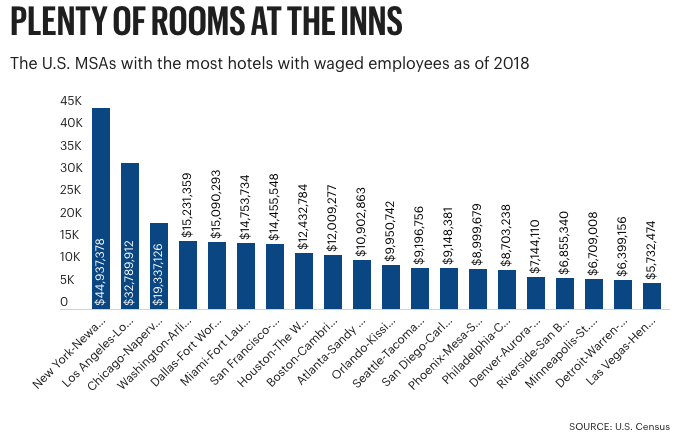

As of 2018, the hotel sector employed about 1.5 million people and supported roughly $43.6 billion in annual payroll. That worked out to just over $29,000 per year, per worker, or about $118 million in U.S. wages each day.

In the Charlotte region, 11,378 are employed in the hotel industry, with an annual payroll of $250.4 million, according to U.S. Census data from 2018.

A spokesman for the AHLA said Treasury, the Fed and SEC acknowledged receipt of its letter. The hotel group, which includes 19,500 members who collectively own approximately half the nation's 55,000 hospitality properties, said it intends to further engage with regulators this week. The industry group ranked among the largest lobbying organizations in Washington, D.C., last year, recording $3.15M in spending, according to OpenSecrets.org.